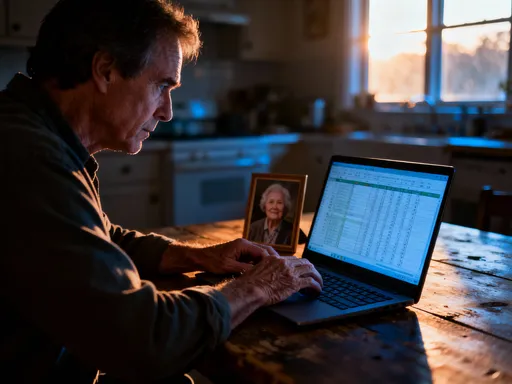

What if the biggest threat to your retirement isn’t market crashes—but the quiet, rising cost of staying healthy? I didn’t think about it until I watched a close friend drained by unexpected care expenses. That moment flipped my entire investing mindset. It’s not just about growth anymore; it’s about resilience, timing, and emotional control. This is the real, unfiltered shift no one talks about—until it’s too late. The realization didn’t come from a financial report or a market forecast, but from a phone call in the middle of the night: a loved one needed help, and the savings meant to last decades vanished in months. That experience forced a reckoning—not just with compassion, but with cold, hard numbers. It revealed a gap in traditional financial planning: the failure to treat long-term care as a central pillar of investment strategy, not an afterthought.

The Wake-Up Call: When Care Costs Hit Home

It started with a fall. A simple misstep on a sidewalk led to a broken hip, then surgery, then rehab, then a slow decline no one saw coming. My friend, a retired schoolteacher, had planned carefully—she had a pension, a modest 401(k), and a paid-off home. But within two years, her life savings were nearly gone, not to luxury or travel, but to home health aides, physical therapy co-pays, and a memory care facility when cognitive issues emerged. She hadn’t anticipated needing years of support, and her investment strategy had been built for income, not for absorbing large, unpredictable outflows. The emotional toll was heavy, but the financial erosion was silent and swift. Her story is not unique. According to U.S. government estimates, nearly 70% of people turning 65 today will require some form of long-term care in their lifetime, with average costs ranging from $50,000 to over $100,000 annually depending on location and level of care. These figures aren’t outliers—they are probabilities, and they demand a fundamental shift in how we think about investing for the later stages of life.

Traditional retirement planning often assumes a smooth arc: save aggressively in your working years, retire at 65, draw down savings gradually, and enjoy a stable lifestyle. But this model rarely accounts for the jagged edges of real life—chronic illness, mobility challenges, or cognitive decline. When care becomes necessary, it doesn’t arrive with a predictable schedule or a fixed price tag. It disrupts cash flow, forces asset liquidation at inopportune times, and can drain resources meant to last decades. The wake-up call for many, like my friend, comes too late—after the market has dipped, after emotions are high, and after options have narrowed. This is why the shift must happen earlier, not as a reaction to crisis, but as a proactive redefinition of financial security. Investing isn’t just about growing wealth; it’s about preserving it when life becomes unpredictable. And that means acknowledging care costs not as a remote possibility, but as a central risk to be planned for with the same seriousness as inflation or market volatility.

Beyond Returns: Rethinking Investment Success

For decades, the financial world has celebrated high returns as the gold standard of success. The investor who doubles their money in five years is held up as a model of savvy decision-making. But when long-term care enters the picture, that definition of success begins to unravel. A portfolio that delivers spectacular growth in bull markets may collapse under pressure when you need it most—during a bear market or a health crisis. True investment success in later life isn’t measured by peak value, but by reliability. It’s not about how high the balance goes, but whether it can sustain withdrawals during downturns, cover unexpected expenses, and adapt to changing needs without derailing the entire plan.

This shift in perspective changes everything. In your 30s and 40s, you can afford risk. A 20% market drop is painful, but time is on your side. You can wait for recovery, keep contributing, and let compounding work its magic. But in your 60s and 70s, the calculus changes. A 20% drop isn’t just a paper loss—it could mean selling assets at a low to pay for care, locking in losses that never recover. That’s why the goal must evolve from maximizing returns to maximizing stability. Capital preservation becomes more important than aggressive growth. The focus shifts to assets that generate consistent income, maintain value over time, and reduce exposure to sharp swings. This doesn’t mean abandoning growth entirely—some equity exposure is still necessary to outpace inflation—but it means structuring the portfolio so that a market correction doesn’t force impossible choices.

Consider two retirees with identical account balances. One has 80% in stocks, chasing high returns. The other has 50% in a mix of dividend-paying equities, high-quality bonds, and cash reserves. When a market downturn hits, the first may be forced to sell depreciated assets to cover care costs, eroding principal permanently. The second can draw from stable income sources and preserved capital, maintaining purchasing power. Over time, the second investor may not have the highest peak balance, but they will likely have the longest-lasting portfolio. This is the quiet redefinition of success: not who earns the most, but who endures the longest.

The Hidden Risk: Emotional Investing in Long-Term Planning

Markets are volatile, but human behavior is even more unpredictable. The greatest risk to any long-term financial plan isn’t a recession—it’s panic. When a loved one needs care, the pressure to act quickly can override years of disciplined planning. Fear of running out of money, guilt over not doing enough, or urgency to secure services can lead to rash decisions: selling investments at market lows, taking on high-fee products, or abandoning a diversified strategy in favor of something that feels safer in the moment. These emotional responses are natural, but they are also financially dangerous.

Behavioral finance has long shown that investors tend to buy high and sell low, driven by optimism at peaks and fear at troughs. When care costs enter the equation, these tendencies are amplified. A diagnosis can trigger a sense of impending crisis, making even well-prepared individuals vulnerable to poor timing. For example, someone might liquidate a low-cost index fund during a market dip to pay for an assisted living deposit, only to miss the recovery that follows. Or they might avoid investing in equities altogether out of fear, locking themselves into low-yield accounts that lose value to inflation over time. The irony is that the very event meant to be prepared for—long-term care—can become the reason the plan fails.

Overcoming this requires more than financial knowledge—it requires emotional discipline. The best defense is a plan built in advance, when emotions are calm. This means setting clear rules for withdrawals, defining triggers for asset reallocation, and establishing emergency buffers that reduce the need to react in crisis. It also means involving trusted advisors or family members who can provide objective input when stress is high. The goal isn’t to eliminate emotion, but to design a system that accounts for it. A portfolio structured for resilience, with built-in safeguards, allows room for human fallibility. It provides confidence that even in difficult moments, the foundation remains intact.

Building Resilience: Allocating for Certainty, Not Just Growth

As we age, our assets must do more than grow—they must protect. Resilience in investing means creating a structure that can absorb shocks without collapsing. This begins with asset allocation, the backbone of any sound strategy. A resilient portfolio balances growth potential with safety, ensuring that not all eggs are in one basket, especially when that basket could be disrupted by health events. The exact mix depends on individual circumstances, but the principle remains: as you approach and enter retirement, the emphasis shifts from accumulation to preservation and income generation.

Low-volatility investments play a critical role in this transition. High-quality bonds, such as U.S. Treasuries or investment-grade municipal bonds, provide steady income and tend to hold value during market turbulence. They act as a stabilizing force, offsetting the swings of equities. Dividend-paying stocks offer another layer, delivering regular cash flow while maintaining exposure to long-term growth. These aren’t flashy investments, but they serve a vital function: they generate income without requiring constant selling of principal. This is especially important when care costs begin, as it reduces the need to liquidate assets at inopportune times.

Liquidity is equally important. Having accessible cash or cash equivalents—such as money market funds or short-term CDs—creates a buffer for immediate expenses. This buffer can cover several months or even years of anticipated care costs, shielding the rest of the portfolio from short-term market conditions. For example, if home health care runs $6,000 a month, having $72,000 in liquid reserves means you can meet those needs for six years without touching long-term investments, even if the market is down. This approach, often called “bucketing,” segments assets by time horizon: cash for near-term needs, bonds for mid-term, and equities for long-term growth. It brings clarity and control, reducing the pressure to make reactive decisions.

No allocation strategy eliminates risk, but a thoughtful one reduces vulnerability. The goal isn’t perfection—it’s progress. By prioritizing stability, income, and liquidity, investors can build a foundation that supports not just retirement, but the full spectrum of life’s later chapters, including the care that many will inevitably need.

Timing Is Everything: Income Flow vs. Lump Sums

How you access your money can be just as important as how much you have. A common mistake in retirement planning is assuming that wealth is a lump sum to be drawn from as needed. But when care costs arise, the timing of withdrawals becomes critical. Selling a large block of investments during a market downturn can devastate a portfolio, locking in losses and reducing future growth potential. This is why the shift from lump-sum reliance to structured income flow is essential for long-term financial health.

Consider a retiree who needs $80,000 for a one-time move into assisted living. If the market is down 25%, they may have to sell $100,000 worth of assets to raise the cash, permanently eroding their base. But if they have a strategy that generates steady income—through dividends, bond interest, or annuity payments—they can cover such costs over time without forced sales. This doesn’t eliminate the expense, but it spreads the impact, allowing the portfolio to recover between withdrawals.

One approach is to layer income sources. A portion of the portfolio can be allocated to immediate needs through short-term instruments, another to mid-term goals via intermediate bonds, and the remainder to long-term growth. Annuities, particularly fixed or deferred income types, can also play a role by guaranteeing a paycheck for life, regardless of market conditions. While not suitable for everyone, they can provide peace of mind when care costs create uncertainty. Similarly, dividend growth stocks offer the potential for rising income over time, helping to keep pace with inflation and increasing care expenses.

The key is alignment: matching the timing of income with the timing of needs. A retiree who expects care costs in their 70s can begin building income streams years in advance, ensuring that when the time comes, the money is available without disruption. This proactive approach transforms care from a financial crisis into a planned event, reducing stress and preserving wealth.

The Planning Blind Spot: Ignoring Care in Investment Conversations

Walk into any financial seminar for retirees, and you’ll hear about travel, hobbies, and legacy planning. Rarely do advisors lead with the question: “How will you pay for long-term care?” Yet it is one of the most significant financial risks of later life. Most retirement models focus on maintaining lifestyle, not on surviving health decline. They assume a smooth glide path to old age, ignoring the reality that many will spend years—sometimes decades—needing support. This blind spot leaves families unprepared, draining savings that were meant to last.

The conversation must change. Care should not be an add-on discussed only after other goals are set. It should be integrated into the core of investment planning, alongside Social Security, pensions, and savings. This means estimating potential care costs early, even in your 50s, and factoring them into withdrawal strategies. It means considering insurance options—not as a last resort, but as a legitimate part of risk management. Long-term care insurance, hybrid life insurance with care riders, or Health Savings Accounts (HSAs) used strategically can all play roles in reducing out-of-pocket burden.

It also means acknowledging family dynamics. Many care costs are hidden in the form of unpaid caregiving by spouses or adult children. While invaluable, this labor has financial implications—lost wages, reduced retirement contributions, and emotional strain. A comprehensive plan considers not just the patient’s finances, but the household’s overall well-being. This broader view leads to smarter investment choices: portfolios that are not only diversified across asset classes, but across time, purpose, and responsibility.

Ignoring care in financial planning is like building a house without a roof. It may look complete, but it won’t withstand the storm. By bringing care into the center of the conversation, investors gain clarity, control, and confidence. They stop pretending that health decline won’t happen and start preparing for it with the same diligence as any other major life event.

Staying Ahead: A Mindset for Lifelong Financial Calm

Financial peace doesn’t come from predicting the market or chasing the next big return. It comes from preparation, discipline, and a mindset shift—from seeking perfection to building endurance. The journey of investing is long, and it will include setbacks, surprises, and moments of doubt. But when care costs are anticipated, not feared, the path becomes clearer. The goal is not to avoid all risk, but to manage it wisely, so that when life changes, your plan doesn’t collapse.

This mindset means regular review, not reactive overhaul. It means adjusting allocations gradually as you age, rebalancing to maintain alignment with goals, and updating assumptions as health or family needs evolve. It means staying informed but not obsessed—following the market enough to stay on course, but not so much that short-term noise dictates long-term decisions. It means accepting that some things are beyond control, but your response doesn’t have to be.

True financial calm comes from knowing you’ve built a structure that can adapt. That if care is needed, there are buffers in place. That your portfolio isn’t just a number on a screen, but a living system designed to support your life, in all its stages. It’s about shifting from fear to foresight, from reaction to readiness. And it’s about recognizing that the most powerful investment you can make isn’t in stocks or bonds—it’s in peace of mind. When you plan for care not as a burden, but as a natural part of life, you reclaim control. You invest not just for wealth, but for dignity, stability, and the quiet confidence that no matter what comes, you’ll be ready.